SoFi - Banking & Investing

3.31.1

Version

Free

Price

3+

Age

Advertisement

Category

Finance

Developer

Social Finance, Inc

Rating

4.8

Version

3.31.1

Safety

100% Safe

Price

Free

Advertisement

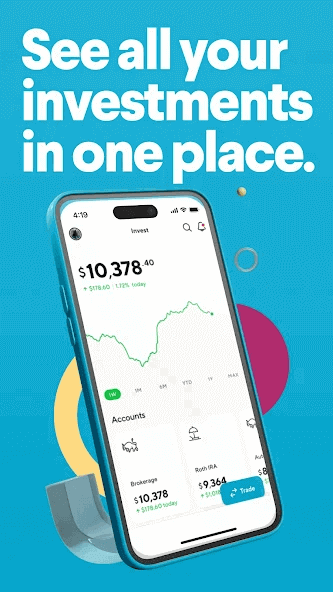

SoFi is an innovative financial services platform that combines banking, investing, lending, and personal finance tools into one easy-to-use app. Designed with a focus on making financial management accessible and straightforward, SoFi provides a wide range of services including checking and savings accounts, credit cards, investment options, student and personal loans, and more. SoFi has gained popularity for its no-fee banking features, competitive rates, and commitment to helping users manage and grow their finances. Whether you're looking to grow your savings, invest in stocks, or manage your budget, SoFi offers a modern, user-friendly platform to help you achieve your financial goals.

SoFi offers a wide range of features designed to help users manage their money efficiently while providing tools for investment, financial growth, and planning. Below are some of the key features and functionalities of SoFi’s banking and investing platform:

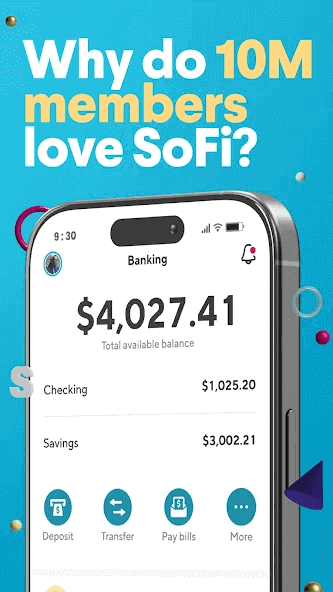

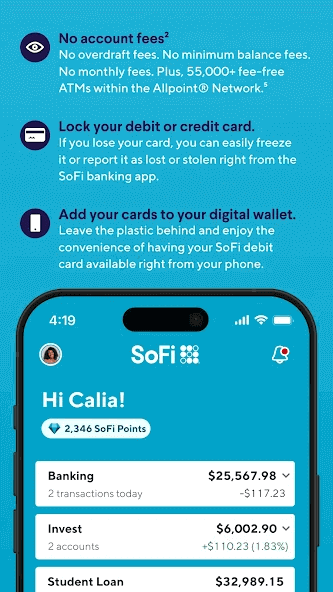

1. No-Fee Checking and Savings Accounts: SoFi provides fee-free checking and savings accounts with competitive interest rates. Users can access their accounts through the app or a physical debit card, and there are no maintenance fees, no minimum balances, and no ATM fees at over 55,000 ATMs nationwide. The savings accounts also offer higher-than-average interest rates, making it easier to grow your money without worrying about fees.

2. Cash Management Account: The SoFi Cash Management Account allows you to combine the benefits of checking and savings. It offers features such as the ability to earn interest, no account fees, and free access to over 55,000 ATMs. This account also comes with a SoFi debit card that can be used for everyday purchases.

3. Investing Tools: SoFi makes investing accessible for beginners and experienced investors alike. Users can invest in stocks, ETFs, and cryptocurrency through the SoFi Invest platform. SoFi also offers automated investment accounts (robo-advisors), which provide personalized portfolios based on your risk tolerance and financial goals. For those who want to take a hands-off approach to investing, SoFi offers a simple way to invest in a diversified portfolio.

4. Retirement Accounts: SoFi provides options for individuals to start saving for retirement through individual retirement accounts (IRAs), including both traditional and Roth IRAs. Users can invest in a range of securities and benefit from tax-advantaged growth, helping to secure their financial future.

5. Student Loan Refinancing: SoFi is well-known for offering student loan refinancing, allowing users to refinance their existing student loans for lower interest rates. SoFi’s student loan refinancing options come with flexible terms and no fees, making it a great option for graduates looking to save on their student loan debt.

6. Personal Loans and Credit Cards: SoFi offers personal loans with competitive interest rates, and users can apply for loans to consolidate debt, fund large expenses, or finance other personal goals. Additionally, SoFi has a credit card that offers cashback rewards on everyday purchases, providing a simple way to earn while spending.

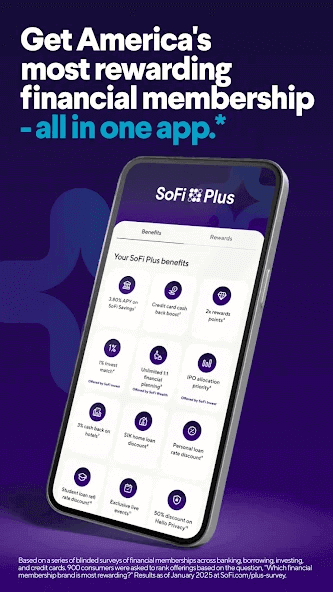

7. Cash Back & Rewards: With SoFi’s credit card, users can earn unlimited cash back on every purchase. SoFi members also benefit from additional rewards when they use the platform for investing, banking, or other services. The rewards can be redeemed for a variety of purposes, including investing, saving, or paying off loans.

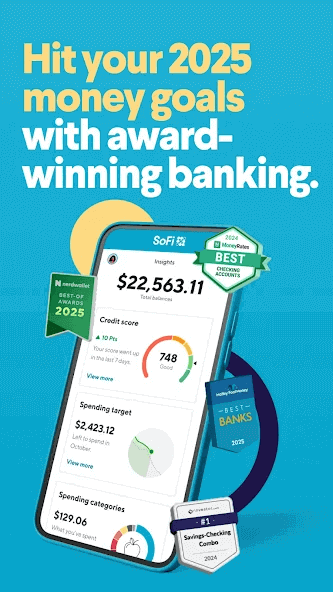

8. Financial Planning Tools: SoFi offers an array of financial planning tools to help users stay on track with their financial goals. These tools include budgeting features, goal-setting capabilities, and financial calculators that help users manage their savings, debt, and investments. SoFi also provides a dedicated financial planner to help guide you through more complex financial decisions.

9. SoFi Relay: SoFi Relay is a free personal finance tracking tool that helps you organize all your financial accounts in one place. You can link external accounts like your credit cards, mortgage, or investment accounts to get a comprehensive view of your finances, track spending, and monitor your financial progress in real-time.

10. User-Friendly Mobile App: The SoFi app is highly rated for its ease of use. Whether you're managing your banking accounts, making an investment, or monitoring your loans, the app provides an intuitive, streamlined experience. SoFi's mobile app also supports biometric logins (face or fingerprint recognition) for added security.

In conclusion, SoFi offers an all-in-one financial platform that makes banking, investing, and personal finance management accessible and easy to use. With features like no-fee banking, cashback rewards, automated investing, retirement accounts, student loan refinancing, and more, SoFi stands out as a versatile and modern financial service provider. The app's focus on making financial tools available to everyone—regardless of experience—coupled with its commitment to low fees and competitive rates, makes it an excellent option for individuals looking to grow their wealth, manage their finances, and plan for the future.

If you're looking for a financial platform that simplifies money management, offers great investing opportunities, and provides tools to manage everything from your bank account to your retirement savings, SoFi is highly recommended. Whether you're new to investing or a seasoned financial planner, SoFi’s intuitive platform and wide range of features make it a great choice for achieving your financial goals. Download the SoFi app today and start taking control of your finances with ease.

Download

Advertisement

Quontic Bank

Finance

4.3

Weather Radar by WeatherBug

Weather

4.5

Armed Forces Bank

Finance

4.3

Klover - Instant Cash Advance

Finance

4.6

Electrify America

Maps & Navigation

4.6

First Internet Bank

Finance

4.7

ChatGPT

Productivity

4.7

Upside: Cash Back - Gas & Food

Travel & Local

4.6

SoFi - Banking & Investing

Finance

4.8