EarnIn: Why Wait for Payday?

15.6

Version

Free

Price

Everyone

Age

Advertisement

Category

Finance

Developer

Activehours Inc.

Rating

4.7

Version

15.6

Safety

100%Safe

Price

Free

Advertisement

EarnIn: Why wait for payday when you can take control of your finances today? EarnIn is a cutting-edge financial management app designed to empower users by providing early access to earned wages, removing stress from traditional pay cycles. With the ability to access funds as they are earned, EarnIn eliminates the need for costly loans or credit card debt, promising a smoother cash flow experience. Designed for both individuals facing occasional cash shortages and those seeking consistent control of their incomes, this app leverages innovative solutions like automatic paycheck tracking and budgeting tools to ensure financial stability. Whether you're struggling with unexpected expenses or just prefer to avoid the wait for payday, EarnIn seamlessly integrates financial independence into your daily life, offering a user-friendly interface and secure transactions. Discover how EarnIn can redefine your approach to managing money and transform your financial habits.

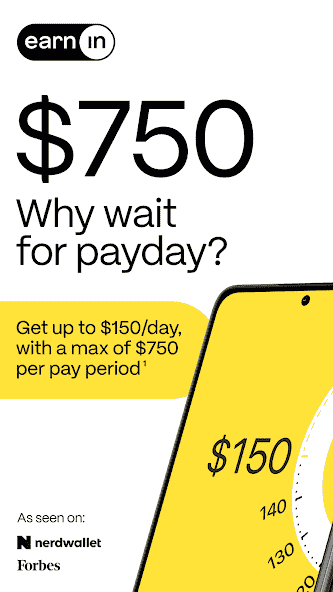

EarnIn stands out in the financial app landscape by offering a unique 'payday advance' model that allows users to access their earned wages before the traditional payday. At its core, the app focuses on financial flexibility, empowering users to cover urgent expenses without resorting to high-interest payday loans or credit card debt. Here's a closer look at its features and functions:

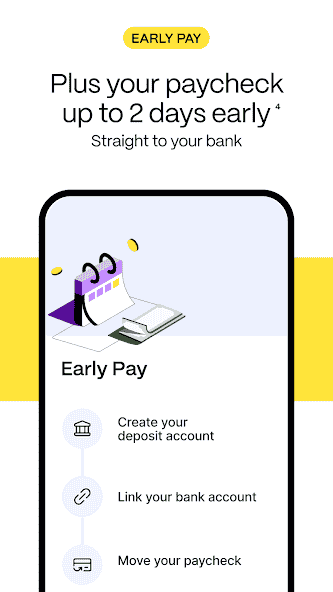

**Instant Access to Earned Wages:** The main attraction of EarnIn is its ability to provide early withdrawal of funds that users have already earned. By linking to your bank account and tracking your paycheck deposits, the app calculates how much you've earned in real-time and allows you to withdraw a portion of that amount when needed.

**Automatic Paycheck Tracking:** EarnIn simplifies the financial management process by automatically monitoring your work hours and tracking income, making it easy to understand how much you can safely withdraw. This feature is particularly beneficial for hourly workers or freelancers who may have unpredictable income patterns.

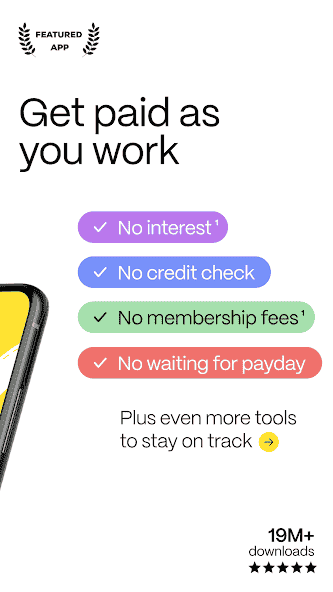

**Zero Interest or Fees:** Unlike traditional payday lending services, EarnIn does not charge interest or impose large fees for advances. Users are encouraged to tip based on their experience, ensuring accessibility for people of all financial circumstances.

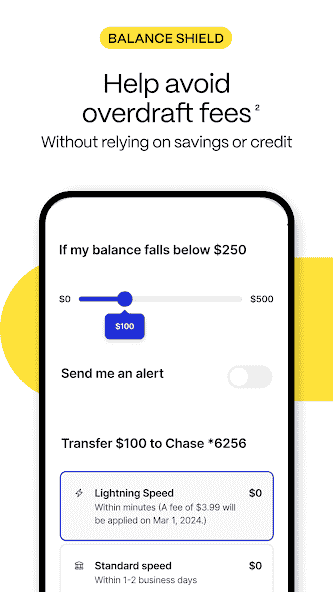

**Budgeting Tools:** Beyond early income access, EarnIn includes helpful tools like balance alerts and budgeting assistance to ensure users don't overspend or exceed their limits. By offering insights into financial habits, the app helps users build healthier money management practices.

**Cash Out Limits & Responsible Borrowing:** To promote sustainable financial practices, EarnIn imposes daily and pay-period cash-out limits, encouraging responsible borrowing and avoiding dependency on frequent advances.

**EarnIn Community Features:** The app also fosters a sense of community by allowing users to contribute to and benefit from the 'Health Aid' feature, which provides financial assistance to others facing medical bills.

**Comparison to Alternatives:** Unlike other advance apps like Dave or PayActiv, EarnIn stands apart with its tip-based structure and no mandatory subscription fees, focusing on user-first designs and transparent operations.

Whether you're an hourly employee, gig worker, or someone in need of financial flexibility, EarnIn delivers an intuitive, secure experience that adapts perfectly to a variety of income situations.

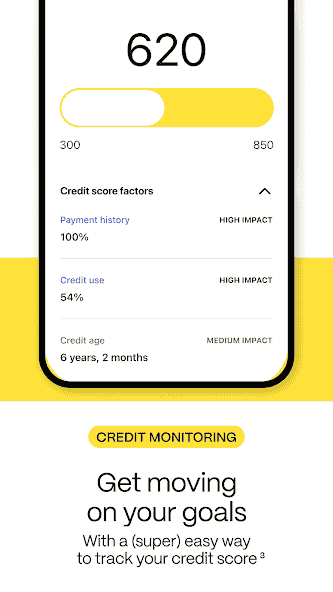

EarnIn is more than just a payday advance app—it’s a comprehensive financial tool that empowers users to take charge of their money on their own terms. By combining flexible early wage access with budgeting assistance, the app addresses not only immediate cash flow needs but also long-term financial health. For those facing an unexpected car repair, a surprise medical bill, or the need to fund daily essentials before payday, EarnIn provides a safe and cost-efficient alternative to high-interest loans or credit cards.

EarnIn’s community-driven features, such as Health Aid, highlight its commitment to social responsibility, making it a standout choice in the finance industry. Its zero-interest model ensures accessibility for people from all socioeconomic backgrounds, while the pay-per-tip system lets users decide what they can afford.

If you’re tired of waiting for payday or need a reliable tool to manage financial gaps, EarnIn’s seamless integration with your bank account and easy-to-use features make it worth exploring. Unlike other apps charging subscription fees or interest rates, EarnIn prioritizes accessibility and fairness in handling your money. For anyone searching for a payday advance app that prioritizes financial independence and affordability, EarnIn is the go-to choice.

Experience the benefits of financial freedom with EarnIn today—your income, your terms, and no more waiting for payday.

Download

Advertisement

PrivadoVPN - VPN App & Proxy

Tools

3.6

H&R Block Tax Prep: File Taxes

Finance

4.3

Western Union Send Money Now

Finance

4.6

The Parking Spot - Spot-On Airport Parking

Maps & Navigation

4.8

Hurdlr Mileage, Expenses & Tax

Finance

4.4

Glassdoor | Jobs & Community

Business

4.6

PlugShare - EV & Tesla Map

Maps & Navigation

4.7

hide.me VPN: The Privacy Guard

Tools

4.4

TaxCaster by TurboTax

Finance

3.7